From Trauma to Triumph: A Latina's Journey to Financial Independence with Linda García

How a teen mom became the million dollar go-to Latina voice in financial education

Want to get right to this week’s podcast episode? Check out Dismantling the Toxic Latine Money Mentality with Wealth Warrior Linda García on your favorite app (or scroll down for the Apple/Spotify players).

This post may contain affiliate links. For more information, please see my Disclosure Policy.

Usually when the topic of childfree people and money are brought up, it's about how we usually have more of it than people with kids. And there's some truth to that to an extent, but people everywhere are feeling that pinch of inflation these days. Everyone, parents and us non-parents too.

This interview with financial educator Linda García isn't about having more money because we don't have kids. It's about deconstructing the negative ideas that Latines have about investing money. Why we should absolutely be doing it, even if we've never felt like that was something for us.

Even though Linda is the exact opposite of childfree, now having two kids herself (and one at a very young age), she’s the Latina breaking down the barriers to investing with her new book Wealth Warrior: Eight Steps for Communities of Color to Conquer the Stock Market.

Wealth Warrior is an absolute must-read if you’ve ever felt intimidated in white spaces.

Yes, it's a super easy to follow instruction guide for getting into the stock market. It's about so much more than just that. At the heart of it is dismantling the idea that being rich, having money, and living comfortably is only for a certain kind of people.

That's the toxic cultural bullshit I refer to in each episode of La Vida Más Chévere.

We ARE allowed to want to be rich. We CAN be rich. And there’s nothing wrong with it. Money is merely a tool we can use to enhance our lives and the lives of our communities.

Money isn’t inherently bad. Pero nuestra cultura has a lot of hang ups around it. Hang ups that California native, and first-gen Latina calls “money wounds” and she wants to help you clear them out.

Here are some stats, according to Gallup:

only 15% of Americans directly own stock (approximately 38-50 million people)

the wealthiest 10% of Americans own 89% of that stock, and 90% are owned by white people

only 1.1% are owned by black people

0.4% belong to Latine people

Don’t you want to increase that last stat to at least a full percentage point? If so, this is how Wealth Warrior will help:

“This highly informative book provides an overview of the products and services that communities of color can access to bridge the wealth gap and provides culturally relevant and actionable advice on how to best take advantage of these opportunities."

Speaking of money, thanks for supporting this Substack! You can also support the show directly for as little as three bucks a month.

As we jump into this interview with Linda, she’s describing how her business has grown in 3 years. For more on her background, check out the full show notes and transcript for Episode 7: Dismantling the Toxic Latine Money Mentality with Wealth Warrior Linda Garcia.

Propelled by Trauma

Linda: We've made a million dollars in revenue since we launched in 2020, and yes, we definitely bring in over six figures a year. Going back to playing on hard mode. Yes. I think that's the only thing I knew how to do. And I am trying to work now in the space where trauma doesn't need to happen to me so that I can propel myself forward.

Because I have been so accustomed to propelling from a traumatic experience, and like where I parent myself and I'm like, it's okay. We don't need the trauma. We don't need the drama. We can be good.

Paulette: Let's talk about that process and what I'm referring to, for anyone listening who doesn't know, your complete backstory is you had a child in high school, you were 14 years old.

And you still went off to college. You still chased after your dreams of working in the Hollywood entertainment industry, and you are now so successful. But the difficulty of all of that leading up to that, plus all the money wounds you talk about in the book that we all have, we'll touch on that in a little bit and I'm so glad that you really take that as your point of departure in the book about how we have to unlearn this.

How long did it take you to unlearn that propulsion from trauma? Like how long did it take to get to the point where that wasn't your fuel?

Linda: It's so interesting because I genuinely feel like it was really prevalent 1000% during my teen years. It was prevalent in my twenties. In my thirties, it started becoming much easier. I was starting to see the fruits of my labor, the fruits of my hard work start to like pay off in my thirties. And in my forties, we've been coasting. I'm 43 now, so I feel like this is act two. And in act two things come much easier. And I've worked extremely hard in my teens, in my twenties, and in my thirties to get us to this place.

And so now the work that I put in is really laying the foundation for who I will be in my fifties and in my sixties. In my seventies even! That's who I'm thinking about. That's who I'm working for. And it's so much easier where I'm at right now than where I was prior.

Wealth Warrior & the Negative Self-Talk

As we focus on her book and defining what a wealth warrior actually is, Linda's going to talk about the war against negative self-talk.

Check out an older episode, Lies We Tell About Ourselves, for more on how to overcome that.

Paulette: Let's talk about the book. It's called Wealth Warrior: Eight Steps for Communities of Color to Conquer the Stock Market. What I loved about this the most is it kind of is a memoir threaded throughout. With then the practical steps of how you go about becoming wealthy or becoming a wealth warrior.

Do you wanna explain what a wealth warrior is?

Linda: Yeah. So if we get to the root of war, I think that's really indicative of my own personal journey in terms of like going through the trenches, having to really navigate and fight your mindset, to open up a new playing field, a new level of experience.

It's the practice, almost like what I see is like a warrior in daily practice on navigating the negative self-talk in the mind and also navigating the negative self-talk of the minds that have raised you, that live next door to you, that are related to you. You know, just navigating that. So that to me is the representation of the warrior in that it's not easy for us to get to the space of wealth, but that we too are deserving and that we too can experience what a journey of wealth means.

Paulette: In the first part, where you talk about false beliefs, there's a part where I related so much to this. You and I are about the same age. I just turned 45 and, you talk about how clothing was really important to you, because as a child you cycled through two different outfits every day and you were made fun of for that. And so that of course, left a huge imprint.

I remember when I was little, my mom1 told me one time that I looked like a picture because I wore the same thing all the time. And in my twenties that did something and I strove to make sure that people never saw me in the same thing twice.

So the credit card bills were out of control. Retail therapy was a real thing. And then the part talking about Jack in the Box, the 99 cent tacos. I remember in college…when you can have dinner for a dollar. Or a dollar 29, whatever it was with tax, a dollar 19. You know, they've gone up in price at certain locations?

Linda: I still eat there when I have big wins. I will consciously go to Jack of the Box just so that I am very clear that Jack of the Box was important. Just because I can go have lobster and a wedge salad, it doesn't take away from what Jack in the Box was able to provide in my youth, and I haven't noticed the price.

Next time I go, I'm gonna definitely check that out.

Paulette: Do you watch Succession by any chance?

Linda: No.

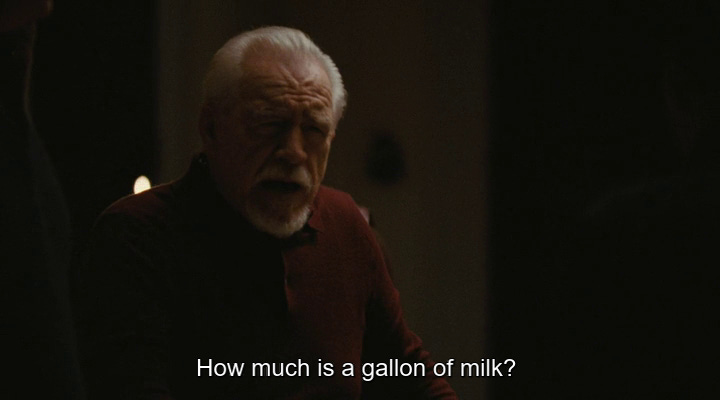

Paulette: Okay, so it's an HBO show about a family of billionaires and they control a legacy media company and the, the patriarch dies and the three kids are scrambling to take control. But at one point the father asked the group of all of them, do you all know what a gallon of milk costs?

And the youngest is the most flippant. And he's like, "I don't know. Who cares?" And I realized in that moment that I didn't know what a gallon of milk costs either. And that was a long way to go from the girl who had to depend on 99 cent tacos for sustenance.

I made a reference to the HBO show Succession because it’s like this Arrested Development meme:

And because being ignorant of these small things is a level of privilege that both Linda and I recognize that we have.

For the record, a gallon of milk right now is about three to $5 here in LA, which seems really expensive to me. Does that seem expensive to you? Leave a comment to tell us how much milk costs where you live.

Listen on Apple:

Listen on Spotify:

Find Linda online at:

To get the full show notes, and an episode transcript, go to PauletteErato.com. And stay tuned for an expanded version of our conversation right here on Substack, coming later this week.

my mom apologized for this, even if though she didn’t need to